Creating an Automated Underwriting Process and Eliminating Manual Work with HubSpot Automation

CLIENT’S CHALLENGE

Background

Challenges

- When a sales rep finished their call with a prospect, the rep had to manually hand everything over to the underwriting team. Details were easily lost in this manual handoff, slowing down approvals.

- Their underwriting team was spending most of their day on data entry instead of reviewing applications.

- Nothing was systemized - There was no standard process to assess risk, no automated compliance tracking in HubSpot, and definitely no time to focus on the complex cases that really needed their expertise.

- To make things worse, they were working with another agency that only handled part of their sales process. The disconnect between sales and underwriting was creating delays, confusion, and missed opportunities.

Solutions

Step 1: Workflow Automation for Underwriting

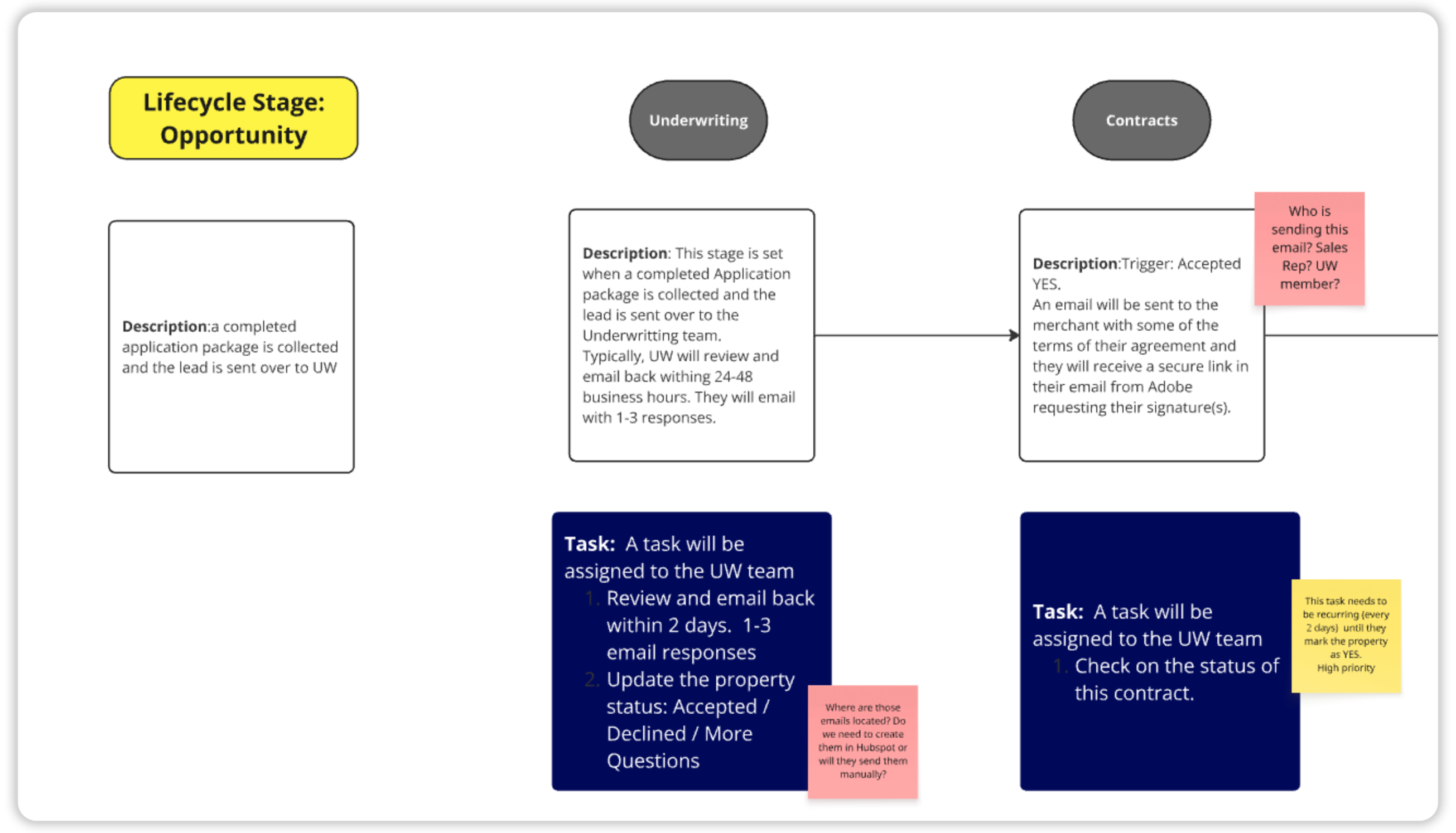

- First, we mapped out their Ideal Underwriting Process on a Mapping Call and created the Miro Board (pictured below).

- Based on the Mapping Call, we built an automated underwriting process that triggers (starts) when a sales rep changes a Lead's status to "Applicant".

- To easily categorize leads, we built 18 different Business Type categories using a HubSpot custom property.

- Set up automated handover process when handling over the prospect from Sales to the Underwriting Team.

- Added compliance workflow automation checkpoints that trigger automatically throughout the process.

Step 2: HubSpot Risk Matrix Implementation

- Designed a comprehensive risk assessment automation in fintech system built directly into HubSpot.

- Created calculated properties that automatically evaluate merchant risk factors.

- Built custom views so the underwriting team can see everything they need at a glance... while not getting bogged down with irrelevant information.

- Set up automatic documentation collection for every risk assessment decision.

Step 3: Enterprise HubSpot Setup for Fintech

- Connected all custom HubSpot workflows for finance between Sales, Marketing, and Service Hubs.

- Created seamless handoffs between departments with automatic notifications.

- Built custom reports and dashboards that show exactly how applications are moving through the system.

- Implemented scalable CRM processes for fintech to handle increased application volume.

Optimization Results

- Fully Automated Workflow: Built a complete automated underwriting process that moves applications from sales to underwriting without any manual handoffs.

- Created Easy Data Categorization: Created a comprehensive classification system of 18 business types using HubSpot custom properties that ensures every merchant gets the right treatment based on their specific business type from day one.

- Automated, Smart Risk Assessment: Implemented a HubSpot risk matrix that evaluates every merchant consistently using the same criteria and documentation standards.

- Seamless Team Integration: Connected sales, underwriting, and service teams with HubSpot CRM for B2B payments so information flows automatically between departments without any gaps or delays.

- Compliance Made Simple: Built automated compliance tracking in HubSpot that happens behind the scenes, ensuring nothing gets missed and maintaining HubSpot for financial compliance standards.

Our client was so satisfied with the results that they expanded their partnership to include comprehensive Sales and Service Hub management across their entire organization!

What's Next?

You Can Get These Results Too.

Just follow these 3 steps:

1. Book Your Free Consultation: Our HubSpot Expert team uncovers what's broken.

2. Receive Your Project Roadmap: Get a strategic plan designed for your specific business goals.

3. Watch the Transformation: See your HubSpot become a money-making machine.

Other case studies

How CoverForce Unified Operations with Custom JIRA Integration, Automated Workflows, and Multi-Pipeline CRM Implementation

Background CoverForce is a B2B InsurTech platform based in New York th.

How Ualett Transformed Their Cash Advance Operations With Custom HubSpot Workflows and Integrations

Background Ualett is a B2B financial services company with offices in .

How Unlmtd Brand Completed a 58-Point Portal Audit and Automated their Subscription Payments

Background Unlmtd Brand is a strategic branding, marketing and content.

Achieving 100% Lead Management Automation: HubSpot Lead Scoring and HubSpot Reports

Background Our client is a B2B financial services company based in the.

How Signature Custom Cabinetry Built Their First Digital Marketing System and Automated Deal Tracking

Background Signature Custom Cabinetry is a B2B and B2C custom furnitur.

How The Hands and Feet Automated Multi-County Service Delivery with Custom HubSpot Workflows and Typeform Integration

Background The Hands and Feet is a B2C nonprofit organization located .

HubSpot Sales Pipeline Cleanup and Optimization for AZ Water Solutions

Background AZ Water Solutions is a B2C water treatment company based i.

How Oakgate Established Professional Brand Consistency Across HubSpot with Custom Templates and Theme Setup

Background Oakgate is a B2C rental management firm located in Californ.

How Appsketiers Improved Sales Visibility with Custom HubSpot Reports

Background Appsketiers is a B2B Custom Mobile and Web App Development .

How Riverside Insights Eliminated 10,552 Duplicates and Built a Custom Hierarchy System in HubSpot

Background Riverside Insights is a tech-based B2B company, based in th.